File photo

The difference in cost between those who can get a mortgage and those who have to rent can be as much as €8,000 per year in costs, according to latest analysis by moneysherpa.ie.

The figures show that monthly costs for renters are significantly higher across the country for those people renting and are unable to get their foot on the property ladder.

The average renter will now pay €3,588 a year more than a buyer taking out a 90% loan to value mortgage on the same property according to analysis by the personal finance website moneysherpa.ie.

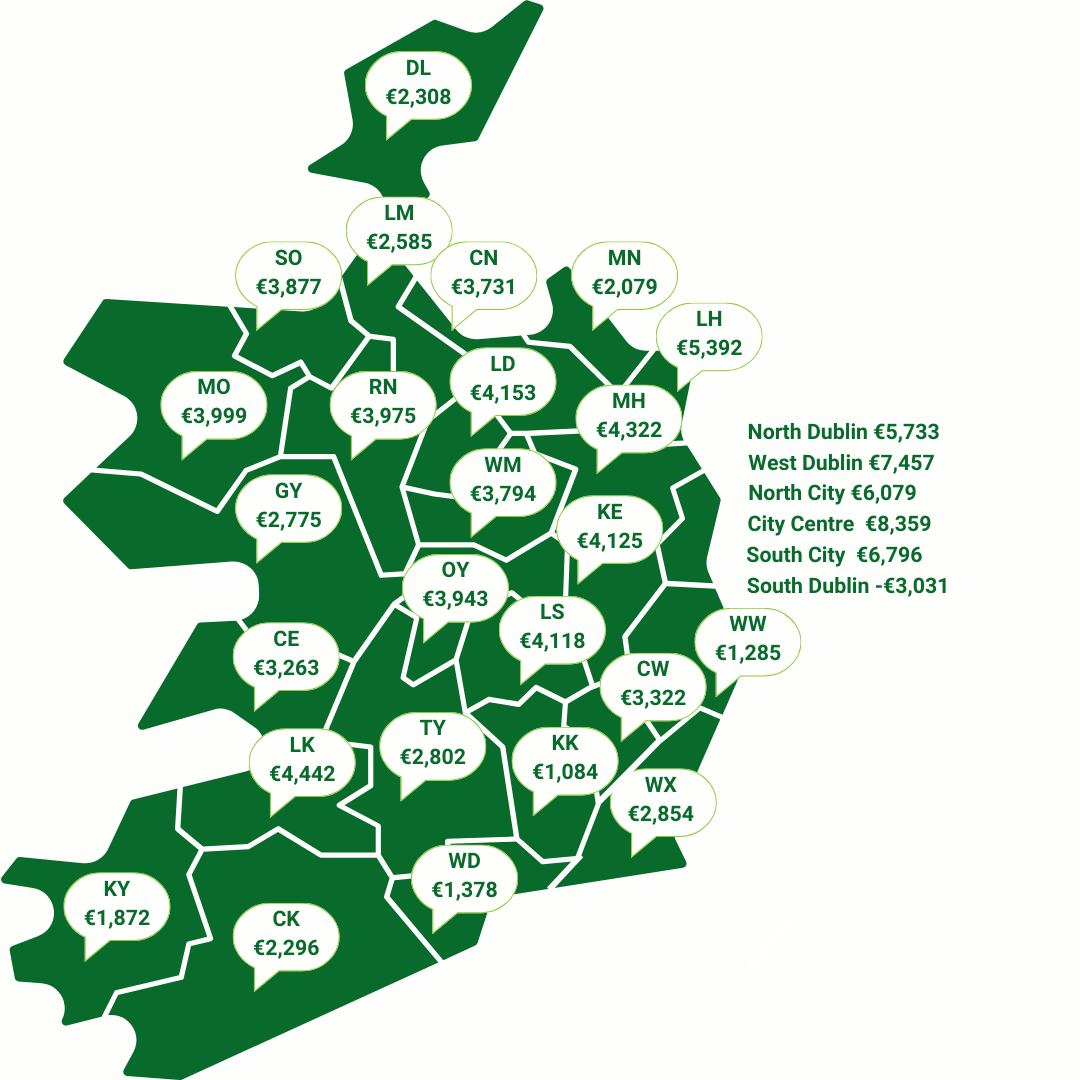

The analysis found that in Dublin, Louth, Limerick, Meath, Longford, Kildare and Mayo renters were paying an average of €4,000 more a year than buyers. With City Centre Dublin showing the highest difference at €8,359 more in rent paid each year and all areas of Dublin paying over €5,700 more versus the repayments on a 90% mortgage on the same property.

The only region in the country where rents are actually lower than mortgage repayments is South County Dublin, where renting is over €3,000 cheaper a year than buying. South County Dublin was very much the exception however, as in all other regions buying saves at least €1,000 a year compared to renting.

The detailed county by county breakdown along with a Buy v Rent Repayment Calculator, so households can calculate how their own monthly rent would compare to a mortgage, can be accessed here

Commenting on the analysis Mark Coan founder of moneysherpa.ie said: “This analysis raises some significant questions about the current mortgage lending rules, which are creating a chasm between those who can get a mortgage and those that can’t.

“Those that can, pay over €100,000 less to live in their home over 30 years and then own a home that they can pass onto to their family if they wish. Those that can’t, pay €100,000 more over 30 years and have nothing to show for it.

“The government, regulators and lenders need to develop more creative solutions to help trapped renters get on the property ladder,” Mr Coan said.

“The idea that expanding grants or relaxing credit rules will inflate housing costs or result in unsustainable repayments is misguided, housing cost inflation and unsustainable repayments are already here in the form of sky high rents.

Relaxing mortgage rules or increasing the scope of grants will simply allow more people to own their own homes and become financially secure,” Mr Coan said.

moneysherpa.ie is an independent personal finance website regulated by the Central Bank of Ireland.

Housing price and rental data is based on the Q3 2023 DAFT Rental Price Report. moneysherpa.ie analysed how rents now compare to the equivalent monthly mortgage payments on the same properties county by county.

Subscribe or register today to discover more from DonegalLive.ie

Buy the e-paper of the Donegal Democrat, Donegal People's Press, Donegal Post and Inish Times here for instant access to Donegal's premier news titles.

Keep up with the latest news from Donegal with our daily newsletter featuring the most important stories of the day delivered to your inbox every evening at 5pm.